12 Car Insurance Myths To Forget & 12 Truths Every Driver Should Know

Back in college, my roommate swore he didn’t need full coverage because his car was red—and “red cars get pulled over more, not totaled.” He said it like it was written into law.

It wasn’t. He believed it so hard that he told it to a cop during a traffic stop. Myths like that spread faster than engine rumors at a tuner meet, and somehow they stick.

Car insurance is already confusing enough without decades of half-baked wisdom muddying the waters.

And while some advice might’ve been true once, a lot of it belongs in the glovebox of history.

1. Myth 1: Red Cars Cost More to Insure

Contrary to popular belief, insurance companies don’t have a color bias. Whether you drive a fiery red or a calming blue, the color of your car doesn’t impact your insurance rate.

Instead, factors like your car’s make, model, and year, as well as your driving history, are what insurers focus on.

So, feel free to choose the color that suits your personality best, without worrying about your insurance premium. After all, isn’t life too short to drive a dull car?

2. Myth 2: Older Drivers Pay More

Think older drivers are automatically shelling out more for insurance? Think again! While age can be a factor, seniors often benefit from experience-related discounts.

Many insurers offer lower rates to older drivers who have a history of safe driving. Plus, some companies provide additional savings if you take a defensive driving course.

So, age like fine wine behind the wheel and you might just see your premiums drop, not rise.

3. Myth 3: Comprehensive Coverage Means ‘Everything’

Comprehensive coverage sounds reassuring, doesn’t it? But don’t be fooled by the name. It doesn’t cover everything!

While it does protect against non-collision events like theft, vandalism, or natural disasters, it doesn’t include collision coverage.

So, if you’re picturing an all-encompassing safety net, it might be time for a reality check. Make sure you understand the specifics of your coverage to avoid unexpected surprises.

4. Myth 4: Sports Cars Are Always Expensive to Insure

Sure, sports cars can be pricey to insure, but it’s not a given. Insurance costs depend on various factors, including the car’s safety features, the cost to repair it, and even its theft rate.

Some sports cars might surprise you with their affordable premiums, especially if they’re equipped with advanced safety technology.

So, don’t rule out that sporty dream ride based solely on assumed insurance costs. Investigate and you might find a pleasant surprise.

5. Myth 5: Insurance Covers Personal Belongings in Your Car

Ever heard the one where your car insurance covers everything inside your vehicle? Sadly, that’s just another myth.

While auto insurance can cover the vehicle itself, it doesn’t extend to personal items stolen from your car. For that kind of protection, you’d need homeowners or renters insurance.

Always check the details of your policy to know what’s covered. Remember, understanding your coverage helps avoid nasty surprises!

6. Myth 6: Your Policy Automatically Covers Rental Cars

Planning to jet set and rent a car? Don’t assume your policy has you covered. While some insurance plans extend coverage to rental vehicles, it’s not a universal truth.

Always confirm with your provider before skipping the rental company’s insurance. A quick call can prevent potential headaches and unexpected costs.

Who knows, it might even help you snag a better deal on your travel adventures!

7. Myth 7: Minimum Coverage is Enough

Opting for the bare minimum might sound tempting for your wallet, but it’s a risky gamble.

Minimum coverage often just meets legal requirements, leaving you vulnerable to out-of-pocket expenses after an accident.

Investing in comprehensive coverage can offer peace of mind and financial protection. It’s all about balancing immediate savings with long-term security.

Don’t skimp on your safety; the right coverage is worth every penny.

8. Myth 8: Young Drivers Can’t Avoid High Rates

Youthful energy doesn’t always mean sky-high insurance rates. While it’s true that young drivers often face higher premiums, there are ways to save.

Good student discounts, safe driving courses, and being added to a family policy can help.

It’s all about demonstrating responsibility and finding the right insurer willing to reward it. So, young drivers, keep those grades up and drive safely to enjoy some surprising savings!

9. Myth 9: Married People Pay Less

Tying the knot doesn’t automatically tie down lower insurance rates. While married drivers often enjoy discounts due to perceived stability, it’s not a universal truth.

Insurers consider various factors, and marriage might just be one of many. It’s the whole picture they look at, not just the ring on your finger.

So, enjoy your wedded bliss, but don’t bank on it for insurance savings alone. There are other ways to cut those costs.

10. Myth 10: All Insurers Offer the Same Rates

Shopping for insurance isn’t like shopping for milk; rates can vary significantly between providers.

Each insurer has its own method for calculating premiums, considering different factors and offering various discounts. Comparing quotes is crucial to ensure you’re getting the best deal.

Don’t settle for the first quote you get; a little research can lead to big savings. Remember, the early bird gets the worm—and the best rate!

11. Myth 11: You Only Need Insurance for New Cars

New car smells are delightful, but that doesn’t mean only new cars need insurance. All vehicles, regardless of age, typically require minimum legal coverage.

In fact, older cars might benefit from comprehensive coverage if they have high value or are costly to repair.

Don’t let the age of your car dictate your insurance needs; assess your vehicle’s worth and risks to choose the best policy.

12. Myth 12: Insurance Covers Engine Failure

Hoping your insurance will cover that unexpected engine breakdown? Think again. Standard auto insurance policies don’t typically cover mechanical failures.

Such issues fall under warranties or specialized mechanical breakdown insurance. Be sure to understand the distinction to avoid disappointment when trouble strikes.

It’s another reminder to read the fine print and know your policy inside out. After all, knowledge is power—and savings!

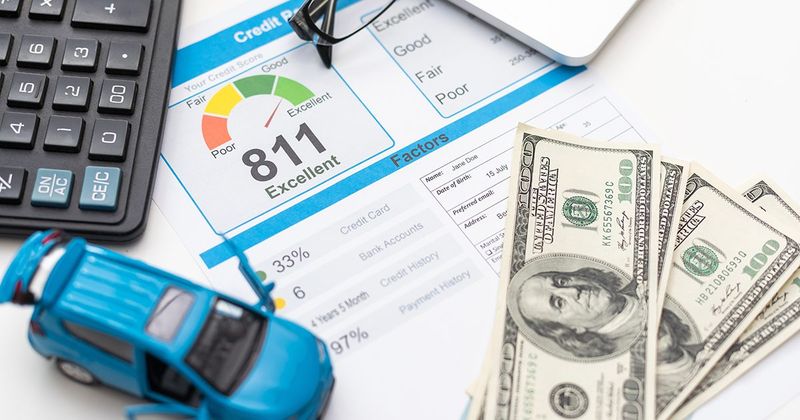

13. Truth 1: Your Credit Score Can Affect Rates

Here’s a truth that might surprise you: your credit score can significantly impact your insurance rates. Insurers often view a good credit score as an indicator of responsibility, translating to lower rates.

Conversely, a less-than-stellar score might lead to higher premiums.

This means that managing your credit well isn’t just good for your finances, it’s also a smart strategy for keeping your car insurance costs in check. So, keep an eye on that score!

14. Truth 2: Where You Live Matters

Location, location, location! It’s not just a real estate mantra; it applies to car insurance too. Urban areas with higher traffic, crime rates, and accident likelihood can lead to increased premiums.

Conversely, living in a quieter, rural area might mean lower insurance costs. So, when considering a move, think about how your new zip code could impact your insurance bill.

It’s not just about the view from your window!

15. Truth 3: Your Mileage Affects Your Premium

The more you drive, the more you pay—it’s a straightforward truth. Insurers consider higher mileage as correlating with a higher risk of accidents, which can bump up your premiums.

If your car is clocking fewer miles due to remote work or a shorter commute, let your insurer know. You might qualify for a low-mileage discount. It’s like getting bonus points for staying close to home!

16. Truth 4: Bundling Can Save You Money

Here’s a tip for the savvy saver: bundling your insurance policies can lead to significant savings.

Many providers offer discounts when you combine your auto insurance with homeowners, renters, or even boat insurance. It’s like a group discount, but for your protection needs!

Not only does bundling simplify your bills, but it also might add some extra cash to your pocket. Who doesn’t love a good deal?

17. Truth 5: Accident Forgiveness Can Be a Lifesaver

Accident forgiveness might sound too good to be true, but many insurers offer it as a perk. This means your first accident won’t cause your premiums to skyrocket.

It’s a little cushion for those honest mistakes on the road. However, it’s not standard across all companies, so you’ll need to check if it’s included in your policy.

It’s like a get-out-of-jail-free card for drivers—now who wouldn’t want that?

18. Truth 6: Safe Driving Discounts Are Real

Safe drivers rejoice! Many insurers offer substantial discounts for maintaining a clean driving record. It’s like getting rewarded for being a responsible road citizen.

Whether it’s a no-claim bonus or a safe driver discount, these incentives can lead to noticeable savings.

So, keep those hands at ten and two, obey the speed limits, and enjoy the perks of safe driving. After all, every safe trip is a penny saved!

19. Truth 7: Telematics Can Lower Your Costs

Technology to the rescue! Telematics devices track your driving habits and can lead to lower premiums if you’re a safe driver.

Think of it as a Fitbit for your car, rewarding you for responsible behavior on the road. Many insurers offer telematics programs that provide personalized discounts based on your actual driving patterns.

It’s a modern way to keep more cash in your pocket while staying safe behind the wheel.

20. Truth 8: Claims Can Raise Your Rates

Filing a claim? Be prepared for a potential rate hike. Most insurers will increase premiums after a claim, viewing it as an increased risk. It’s the classic case of cause and effect in the insurance world.

Consider the cost-effectiveness of filing small claims, as it might be cheaper in the long run to pay out of pocket. Smart decisions today can lead to significant savings tomorrow. Choose wisely!

21. Truth 9: Customizing Your Car Can Increase Rates

Thinking about pimping your ride? Be cautious, as modifications can lead to higher premiums. Insurers often view customized cars as higher risk due to increased repair costs and theft appeal.

Ensure you inform your provider of any modifications to avoid invalidating your policy.

It’s a trade-off between personalizing your vehicle and keeping insurance costs manageable. Always weigh the benefits against the potential costs.

22. Truth 10: Gender Can Influence Rates

In the world of insurance, gender can be a determining factor. Typically, young male drivers face higher premiums due to statistical risk factors associated with their age group.

While the gap narrows with age, it’s a reminder of how nuanced insurance calculations can be.

So, gentlemen, drive safely and responsibly—it’s worth it in the long run. And ladies, enjoy those slightly lower rates while you can!

23. Truth 11: Loyalty Can Pay Off

Sticking with the same insurer over the years can bring rewards. Many companies offer loyalty discounts to long-term customers, appreciating their continued patronage.

However, it’s still wise to periodically compare rates to ensure you’re benefiting from the best deal.

A little loyalty can go a long way, but financial savvy should always guide your decisions. Stay informed and enjoy the perks of being a valued customer.

24. Truth 12: Insurance Rates Can Be Negotiated

Don’t settle for the sticker price! Some aspects of your insurance rate can be negotiated.

Whether it’s asking for additional discounts or shopping around for better offers, being proactive can lead to savings.

Insurers value informed customers who aren’t afraid to ask questions. So, channel your inner negotiator and see how much you could save. Who wouldn’t want to pay less for the same coverage?